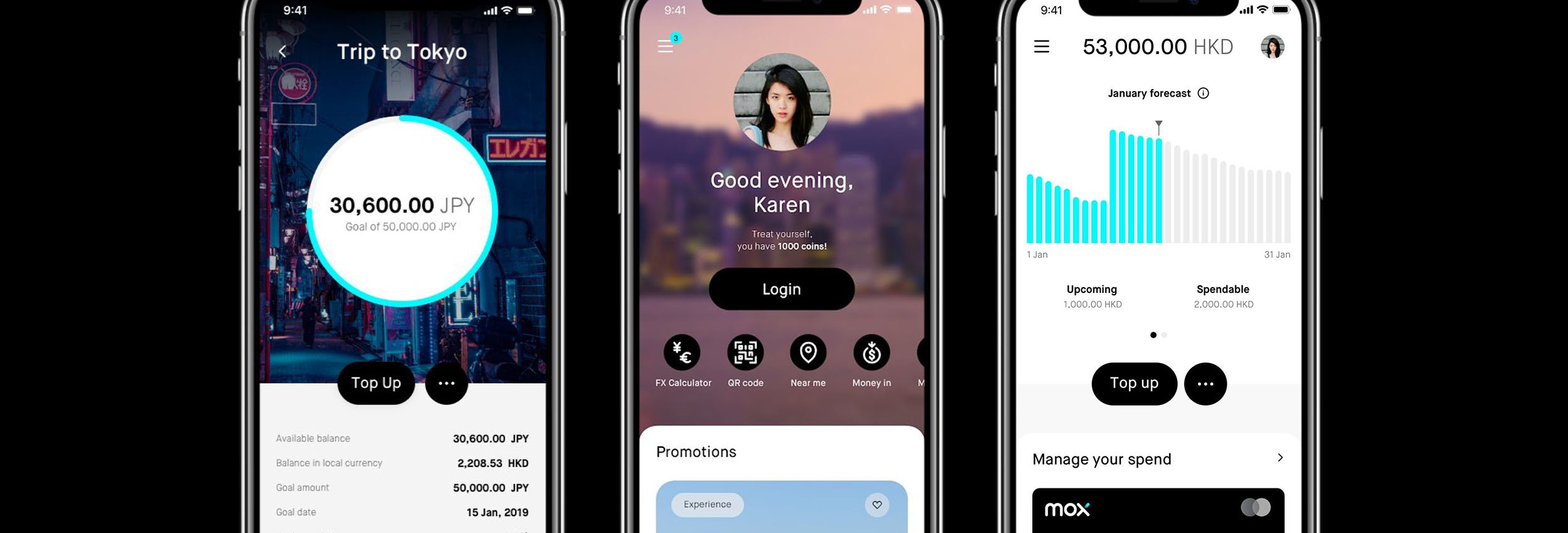

Mox by Standard Chartered, Hong Kong

Designing a virtual bank app targeted at Hong Kong’s affluent millennials

Features Definition & Design • Design System

Standard Chartered Bank was awarded one of the first digital bank licenses in Hong Kong. I was part of the team at R/GA tasked to design the MVP for their digital product.

Hong Kong is an expensive city to live in and many millennials find it difficult to manage their expenses. They often find themselves living from paycheck to paycheck and are often broke by the end of their pay cycle. The natural of jobs is also changing. More people are freelancing and going into the gig economy where their paycheck is no longer “at the end of month”.

Traditional banking systems are not keeping up with the lifestyle changes of this new generation. It is often fragmented across various touchpoints, lacking in timely updates of one’s overall finances.

Taping on key cultural and behavioural insights, Mox aims to help millennials save and plan their finances better. Features are also designed based on Hong Kongers’ “Jetso” mindset of maximising every dollar, allowing customers to “earn as they spend” and rewarding them for their engagement with the bank. Every touchpoint in Mox’s smart banking system aims to make banking less of a chore and more of something that integrates into their lifestyles.

Collaborating with a team of product owners, UX and UI designers, writers, and project managers, we worked in 2-week sprints to deliver a total of 10 epics within 4 months.

My Role

I led design development for 3 epics – “onboarding and account opening”, “loans”, and “rewards & gamification”. My key tasks include,

Refinement of user stories with product teams

Sketching and exploration with product teams

Wireframing and user flow development

Review and iteration of designs

Documentation of flow logic, interaction patterns, rules and guidelines

ONBOARDING AND ACCOUNT OPENING

Instant account opening and approval within minutes.

In line with the millennial mindset of wanting things quick and efficient, Mox allows anyone with a Hong Kong ID and residential address to open an account for free through its app, anytime, anywhere.

Hassle free submission of documents through Mox’s app

Minimal form filling required as personal particulars are automatically captured by scanning of ID card

Conversational UI for a more friendly interaction

Verification of identity through “blinking selfie” and SMS OTP

LOANS & BORROWING

Instant loans 24/7 within the Mox app.

Mox offers instant approval for a variety of loans within its app, providing more flexibility in cash flow. Loans like “advance my pay” and “split my purchase” are specially tailored to the present day needs of young working adults.

Preapproved loan amounts based on customer’s credit rating

No additional documents required for loan application

Flexible repayment periods between 3 to 60 months

Instant calculation of repayment amount and interest with loan calculators

Contextual entry points to loan application eg. from account balance, credit card transactions, analytics.

Key flows within this epic:

Application for different loan types

Application to increase credit limit

Loan module on dashboard, loan product details, manage loan details

Repayment flow from various entry points

“Skip repayment” and “edit repayment schedule”

REWARDS & GAMIFICATION

Tiered reward system that unlocks more app features and exclusive experiences as customers increase their engagement on the app.

Customers earn more reward points and level up reward tiers as they increase their engagement on the Mox app. Each tier unlocks “bonus features” on the app and exclusive experiences tailored to individual interests.

Daily treats and access to exclusive lifestyle events and deals

Play games with friends to earn more points

Complete a series of tasks (Missions) to access more deals

Key flows within this epic:

Rewards dashboard and leveling up

“Mission” details and progress

Game details, start a game, invite a friend

Notifications in various context

Outcomes

Two years in the making, Mox officially launched in Hong Kong in 2020.

As of 2021, it has more than 200,000 users, tripling the figure for 2020.